The Basics, Income & Expenses

April is Financial Literacy Month

The National Financial Educators Council (NFEC) defines financial literacy as “possessing the skills & knowledge on financial matters to confidently take effective action that best fulfills an individual’s personal, family & global community goals.”

keywords? “Take Effective Action”.

This week I want to talk about the very basis and foundation of financial planning, the pillars on which this is all built, namely your income and expenses and your income and expenses. How are these connected? How do they fit into an overall financial plan? How and what action should you take?

We start with Your Income.

There are two types of Income, Active Income, and Passive Income. Active Income is earnings you earn by being physically present to work (does not have to be geographical). This includes salaries as an employee and owner drawings as an owner. Passive Income is all income you earn when not physically present or by ownership. It includes rents, dividends even your share as a silent partner in a business.

How are Your Active and Passive Income connected?

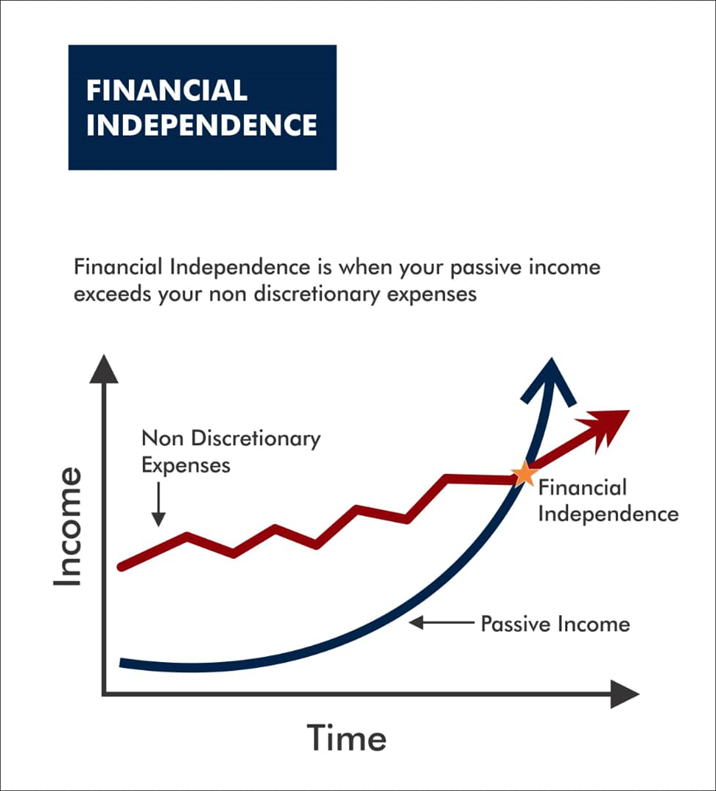

If you are employed, you earn a salary; even as the business owner, you get paid by showing up. The active earnings you make are time-bound because you cannot work forever. Thus, the plan is to slowly convert your active income to passive income. Created a closed system when you invest, then reinvest your earnings from your portfolio to compound your returns. See figure 1.

An example will be you earn N500,000 a month. You have a plan to save a minimum of 10% of every paycheck, thus N50,000. Therefore, your action goal is to invest N50,000 into an asset class that either.

- Generates passive income for you

- Reduces your level of expenses

Thus, if you buy Zenith Shares with that N50,000, you want to take dividends paid by Zenith Bank and buy more income-generating assets or expense reducing future expenses like paying for rent.

Goal: To plan to convert 100% active income to passive income over a period. Keep it simple, target 1%, then 2%…then 3% over

Figure 1. Relationship between Income and Expenses

Now Expenses

Just like income, there are two types of expenses. You have your Non-Discretionary Expenses, which are expenses you must make irrespective of income or even ability to pay, for instance, food and rent. We can call these necessary expenses. Then there are Discretionary expenses, which are expenses you are at discretion to make. Expenses like a holiday to Greece or a new suit fall into this category.

With expenses, spending becomes critical. Spending is an activity based on emotions. Humans are not always rational when making spending decisions. Remember that every naira earmarked as non-discretionary means fewer funds are available to be spent as discretionary. If all expenses are tagged as “essential” then it makes budgeting a cumbersome process.

How are Your Non-Discretionary and Discretionary Expenses connected?

Your total income, (both active and passive) should meet and exceed expenses. If your expenditures exceed your income, you can either cut back on spending or learn a skill and grow your income. Cutting back on spending is 100% in your control. It’s also not easy to distinguish between Non-Discretionary and Discretionary spending. Take food, is eating out at a restaurant non-Discretionary? You can save money by eating at home.

The long-term goal is to ensure not only your income meets expenses, but the acid test is how much of your passive income can offset your non-discretionary expenses. See figure 2

Managing expenses is creating and using a budget to capture and track spending. Your budget should have all four elements

- Active Income

- Passive Income

- Non-Discretionary Income

- Discretionary Income

I write about this in more detail in my book “Let’s talk about your money”

There is a gap between income and expenses, which is usually covered by debt. It’s important not to borrow to fund non-Discretionary expenses but to use debt to grow passive income generating sources.

When Can You Retire?

Retirement is not a chronological date but the period when your passive income can meet and cover your non-Discretionary expenses. Again, we refer to diagram 2

Figure 2: Financial Independence

Your goal, employee, or employer, is first to earn an income, then slowly invest that income to earn and grow your passive income. Next is to seek to pay your essential non-discretionary expenses with the income from your passive income. Once you can achieve that, you have hit your financial independence milestone and can retire.

It’s that simple.

Comments are closed.