Last week I got a letter from a lady, she wrote,

“Kalu, I have about N5m; I would like to invest it. I am high-risk averse, I am not interested in stocks, either the US or foreign, I am also not interested in trading or crypto, etc.

I want my principal intact as part of this is my deposit for my child’s education from 2025. I know I have to do bank placements, but I don’t understand bonds or the best way to do this.”

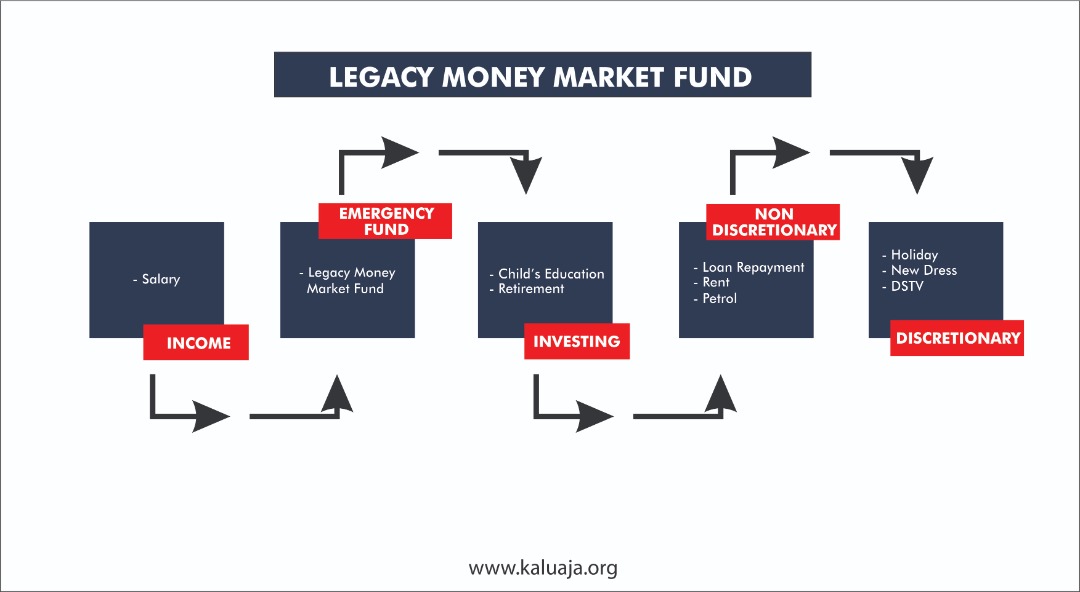

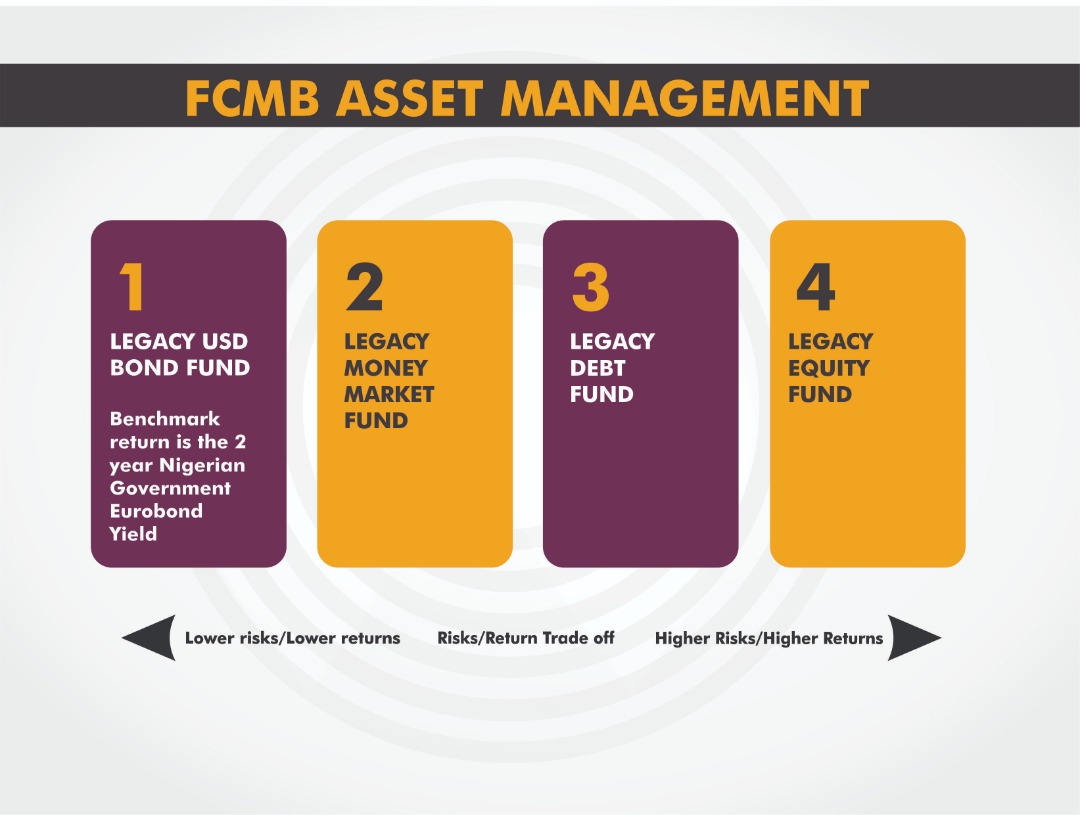

This is an exciting brief; how can you invest using only fixed income options? I will keep this quite simple for you; I will use the accounts you can find in any bank. I invest with FCMB Asset Management, I selected three fixed income products in diagram one below that can allow this client to meet her objectives as below.

The Risk v Return Spectrum

Think of investing as a spectrum; on one end, you have the objective of capital appreciation, meaning the aim is to expose the principal sum to volatility so it can appreciate or (sadly) depreciate.

Since the principal can appreciate and depreciate its termed variable because returns are variable and volatile. Buying shares in a good company is an example of a variable return investment.

Owning shares allow an investor to share in the growth (and decline) of good companies, but you cannot determine with certainty the final return as it is based on future earnings.

On the other end, we have Fixed Income investments where the principal is not exposed to any risk of default subject to the strength of the issuer. The investment objective of fixed income investing is capital preservation to earn a return or income on the principal sum.

Holding Cash and Money Market instruments with a tenor of less than one year are also capital preservation products. Fixed income does not mean zero risk; it simply means lower risk than variable income. The rule is this, the longer the tenor, the more volatility you are taking on.

The critical risks you will face with fixed income are

Issuer risk: Does the instrument’s issuer have enough liquidity to pay the interest and principal?

Reinvestment risk: can you roll over your investment at the same rate as previous or higher.

Interest rate risk: interest rate will rise, and the price of the debt instrument will fall.

First, What’s Your Objective and Risk Profile

The lady was straightforward, “I don’t want to risk”, implying she does not want to take on risk or volatility in returns when invested, thus a capital preservation goal. This means she will forgo the opportunity to earn a potential higher return by accepting volatility. She makes a fixed rate of return, which may not necessarily beat inflation.

Based on her objectives, asset classes recommended are.

- Cash

- Money Market

- Debt

She cannot do equity even if equity gives her a higher return. A lesson is to invest in matching your investment objectives to the appropriate asset class, not returns.

How Should You Invest?

The Emergency Fund

When investing in fixed income, matching your investment duration to the duration is particularly important. This means if you have a maximum investment horizon, you should not invest in securities that will exceed that horizon. In this case, the time horizon is 30 months, so how should she invest?

The first thing is to place at least 3 to 6 months of her necessary expenses in an emergency fund. When you invest in fixed income, you are locking up those funds with the bank for a set period; you will be charged a penalty should you seek to take out your deposit before the lock period.

Creating an emergency fund and investing in cash or near cash fixed income means She can quickly get to her funds during an emergency. If an emergency happens within 60 months, the lady can access money by withdrawing from this emergency fund without paying the penalty by early redemption of the other investment she has fixed.

In this example, I will advise she places her emergency funds in a call deposit or a money market fund. Money market funds are perfect for emergency funds because they allow the investor to earn a higher return than call deposits; see diagram one. they also enable rolling over deposits that compound your returns. See diagram one.

In this case, if she estimates her six months’ necessary expenses are 500,000, she can invest 500,000 in the legacy money market fund. She gets a reasonable rate, liquidity assurance, and no principal risk.

Managing Interest rate

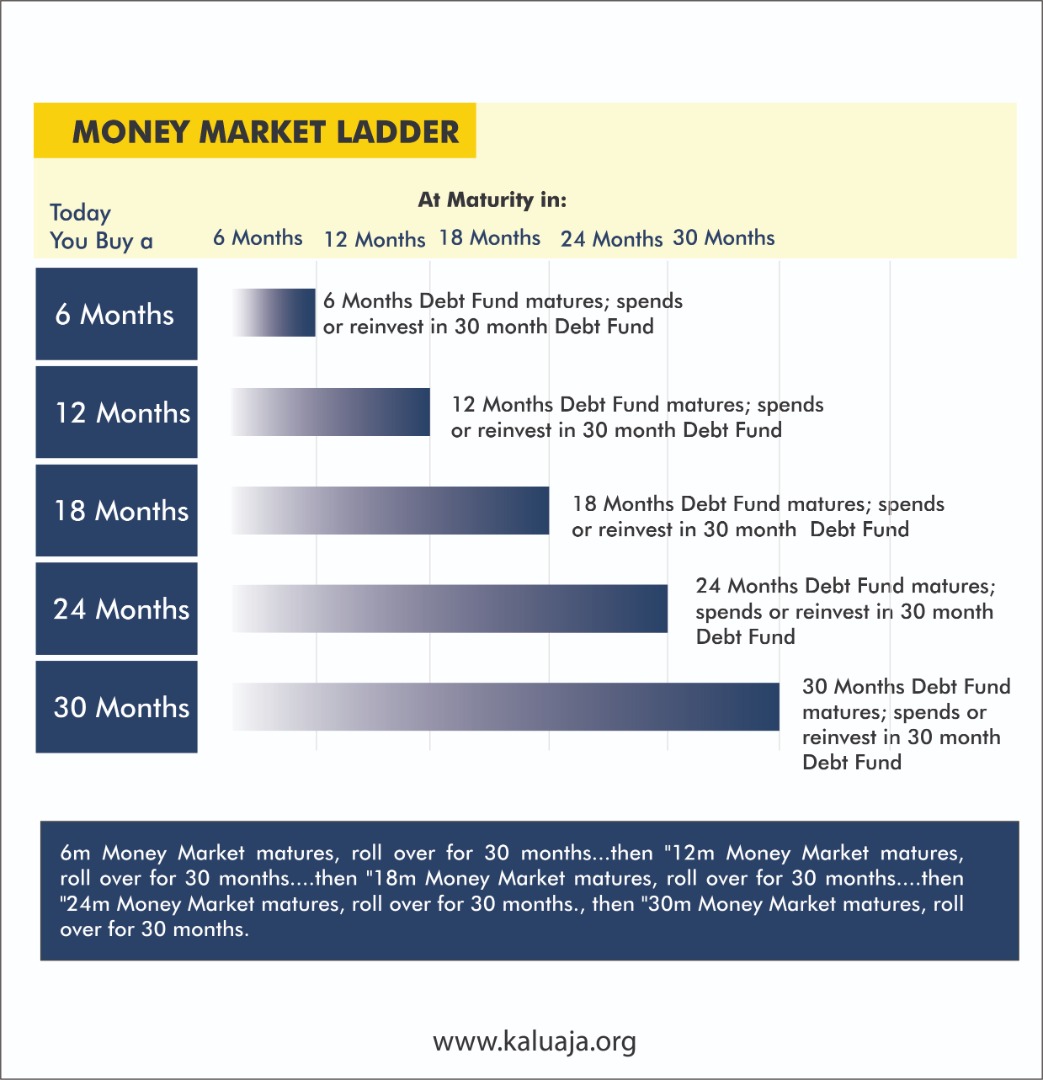

Interest rate and inflation risk are the risk in fixed income investing. With a long time, horizon of 60 months, what about inflation? If rates fall and you have locked in your principal for 60 months, then what? The solution is to buy a debt fund but use a ladder strategy.

A ladder strategy is an investing strategy when you stagger your maturity dates. It works this way; instead of making a bulk N2.5m investment in a debt instrument for three years, you can split the 2.5m into lots of N500,000 and then invest in a staggered six-month schedule.

Diagram two should show how this is done for a 30-month tenor.

Each six-month period, a portion of the debt instrument the lady has invested in will mature; thus, you reinvest at a higher rate if interest rates are up. If rates have fallen, then you can reevaluate. You are therefore not locked into a three-year investment.

What About Inflation

We cannot escape the systematic risk of Naira inflation when we invest in Naira. Thus, to avoid inflation, we must diversify and invest in other currencies to spread out risk.

The Nigerian Federal Government has issued Eurobond (Nigerian bonds issued in another currency), usually the US dollar. Buying these bonds requires having about $200,000 in investible funds, but some funds allow investors to buy into open-ended funds that have exposure to those Nigerian Eurobonds.

Since we have a long-term horizon, we can diversify and hedge or protect the value of our portfolio by investing about 30% in the Legacy USD bond Fund. This diversification protects the portfolio from the systematic naira risk. So let us summarize what we have proposed.

- 3-6 months in a cash call or Money Market Fund as Emergency Fund

- Fifty percent in a laddered Legacy Debt Fund

- Fifty percent in the Legacy USD Fund

This allocation satisfies the safety of principal, and it also allows compounding via the money market fund and, most importantly, hedges against Naira inflation via the Eurobond investment. The principal sum is protected and offers reasonable growth as well

Do follow on @finplankaluaja1

Comments are closed.