“Kalu, I am 45, and I have never had a budget. Every book I read says I should have a budget. My question is this, is a budget essential? I earn enough money, and I can spend and still save. Do I need a budget even though I and financially comfortable? and how should I prepare a budget?”

I have noticed that many individuals do not have the habit of keeping a budget. There are many reasons for it; the gentleman that wrote to me said he does not keep a budget because he believes a budget is for tracking expenses when your income can’t meet your needs. He makes enough, so why should he budget. Great Question.

A budget is not an alone stand document, and a budget links your income and expenditure to a goal. If you have any financial goals, you have to measure your progress in reaching that goal with regular budget reviews. A Budget also acts as a habit or behavior change tool. If you want to change a wasteful spending habit, create a budget for that expense and slowly reduce how much you allocate to that expenditure item. This week, I will give you the step by step guide on how to create a cash budget

Eight Steps to Create a Budget

- What is your goal?: Everyone needs a goal, especially a financial goal. When you have a goal, it causes resources to become focused on achieving that goal. For instance, A nation could have a goal of becoming self-sufficient in steel manufacturing; thus, it will budget and earmark resources towards that goal. On a personal level, what is your goal? Do you want to buy a home? Or start a business? Everyone has a money goal. Bill Gates’s goal may be to fund his charitable foundation without dissipation. Nigeria, like every nation, has an economic plan that addresses the vision, then the medium Term Plan, then an annual budget. China has 10-year plans. The goal is the first step. It would help if you had a measurable goal, thus instead of; “I want to be comfortable in retirement”, rather say, “I want to earn 15% of my current income in 15 years; this will enable me to have a comfortable retirement. This goal is measurable has a timeline and a purpose. Next?

- Record all income: The next step is to record your income, down to the kobo. Income is more straightforward because most folks have a job and earn a salary paid to the bank account. However, with the income, you want to separate all revenue into;

- Active Income: Income you earn by being physically or engaged at work; you earn a salary from physical labour.

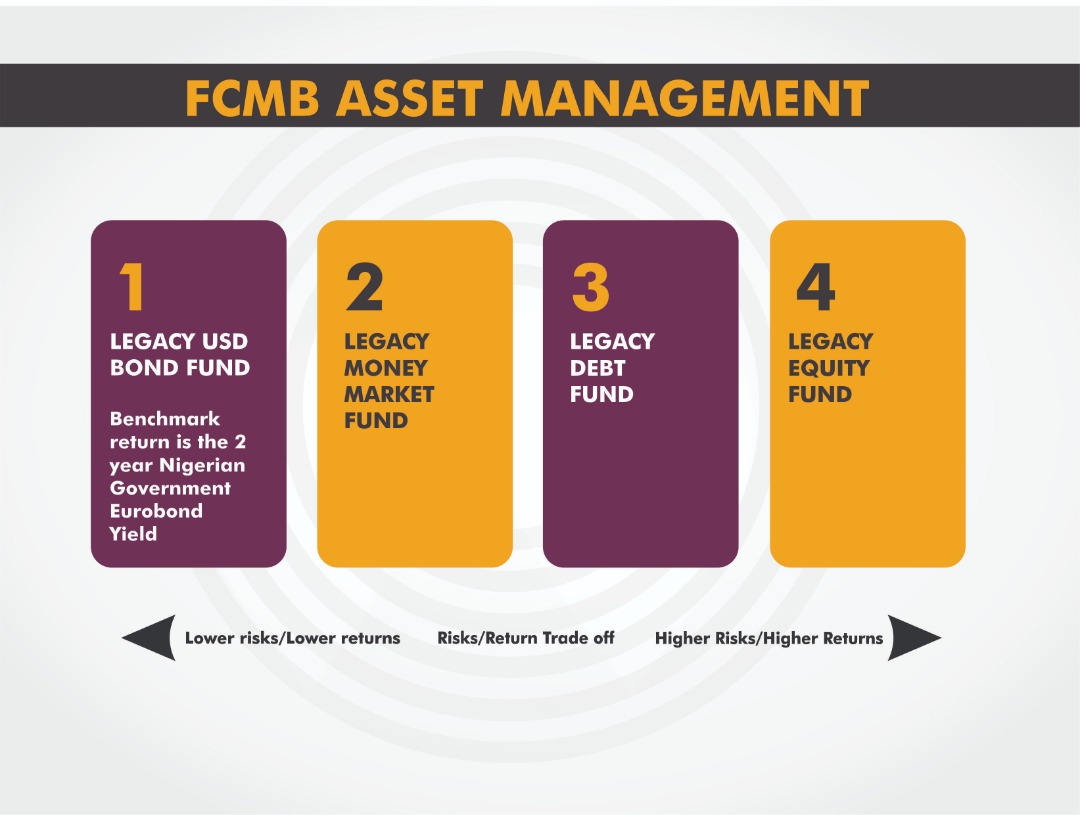

- Passive Income: Income you earn even when you are not at work. An example will be a dividend paid to you by a company you invested in or rent. See Diagram 1.

- Next, you record all expenditures; this is similar to capturing all income. Expenses are more random and widespread than incomes. It would help if you captured every cent of spending you make, no “miscellaneous”. The best way to do this is to track your spending with spending apps like Mint®. You can also use an excel sheet or buy a small notepad with a pen and write down everything you spend money on in detail. I recommend you do this over 90 days, but 30 days of expenses are sufficient to start

- Create Categories from your Expenses: after detailing your expenses, group your expenses into two categories, Discretionary and Non Discretionary Expenses. Then allocate each expense made to either Discretionary and Non-Discretionary. E.g. eating out in a restaurant can be Discretionary, but groceries to eat at home will be Non-Discretionary. Remember, there are no rules to this; you have to decide if that gym membership is discretionary.

- Discretionary Expenses: these are expenses that you have the discretion to make. You can elect to make them or not make them. E.g. going for a holiday in Dubai. You can select not to go

- Non-Discretionary Expenses: These are expenses you must make irrespective of your financial situation—e.g. food and rent. You have to eat, and you need to pay rent. These are Non-Negotiable expenses; you can delay, but they must be made.

- Review your Income to Expenses; before you proceed to prepare a budget, calculate your total income and compare it to your total Non-Discretionary Expenses. This figure must be positive, meaning you must earn enough to meet your necessary expenses. If this figure is negative, you must stop and review your income to raise it or determine which expenses are Non-discretionary.

- Determine the review period; you should determine when you will review compliance with your budget. This review could be weekly, monthly, quarterly or annually. This means you create a review column and track your progress towards that activity on the columns where you follow your income and expenses.

- Record your expenses for a minimum of 30 days. Record your expenses, categorize them, and apportion them. Only after this initial apportionment do you now create a budget. E.g. you spend N15,000 on fuel for your car in 90 days, you then know how much to allocate based on your actual spending. In this case, if you’re going to reduce overall expenses, you can reduce fuel expenses or reduce other expense headers to maintain your fuel spend. This is the importance of the budget, the reviewing your actual allocation, to either increase or decrease spending to achieve a financial goal.

- Your daily budget goal is to ensure your total income meets all recorded expenses. However, your retirement goal is to have your passive income cover your Non-discretionary costs. Once your passive income can cover your non-discretionary payment, you can retire.

To summarize, a budget works to fund a predefined financial goal. If you want to buy a home, you deploy a budget to create a cash flow that supports that goal to channel your savings and reduce expenditure. A budget introduces discipline to your spending. If you can cover all your expenses, you have a budget that allocates more to invest and generate passive income. Your goal can then be what percentage of your income is passive. See Figure 2

Other Considerations.

Your most essential spending item is “Paying Yourself First (PYF). Once you record your income, a percentage of your total income goes towards investing to generate passive income for you. For instance, make an additional contribution to your retirement Savings account or increase your Emergency Fund. This is a Non-Discretionary Expenses. If you make every expense a necessary expense, it is difficult to cut down on costs.

In closing, a budget is how you implement and control a financial goal. It allows you to deploy resources and also reduce spending. A budget is only as good as it’s implemented. Discipline is thus a fundamental part of any budget

Comments are closed.