The CBN Currently Is Autonomous

According to the CBN Act of 2007, the Central Bank of Nigeria (CBN) is a fully autonomous body. Central banks need autonomy to perform their duties because their objectives are not always synchronized with executive and legislative actions.

What is the Role of a Central Bank?

All Central Banks fight inflation and maintain monetary and price stability as their primary purpose. Some Central Banks like the US Federal Reserve have other mandates like “full employment”, but Centrals Banks generally fight inflation.

The CBN, for example, has many goals, including

- Ensure monetary and price stability;

- Issue legal tender currency in Nigeria;

- Maintain external reserves to safeguard the international value of the legal tender currency;

- Promote a sound financial system in Nigeria; and

- Act as a banker and provide economic and financial advice to the Federal Government.

Why Do Central Banks Need Autonomy?

William McChesney Martin is credited with this quote; “the federal reserve is in the position of the chaperone who ordered the punch bowl removed just when the party was warming up.”

In democracies, political parties seek votes from the voting public with promises. Those promises like “I will build a new bridge” involve spending. The executive and legislative will seek to spend to fulfill those electoral promises. Spending introduces cash into the economy. Where there is a lot of money moving through the system with velocity, chasing too few goods without increasing the rate of productivity, inflation occurs.

If a politician in a small Local Government Area like Ohafia in Abia State spends an N1billion (with a b) to build a new road, there will be workers hired; those workers need to eat, and suddenly the price of garri will shoot up as those workers all buy gari to eat lunch. This increase in prices in Ohafia is what economists call Demand-Pull Inflation.

The job of the Executive is to spend and provide the dividends of democracies like new bridges to the electorate, this spending clashes with the mandate of the CBN to maintain price stability. The CBN needs its independence to counter the executive’s spending to ensure the nation’s economy is not destroyed by hyperinflation. If the CBN is not independent, the executive can artificially keep interest rates low, print cash, flood the system with liquidity, destroy savings, and introduce hyperinflation—think of Zimbabwe 100 trillion Zimbabwean notes.

The CBN has Not Always Been Autonomous.

In 1997, the Federal Military Government of Nigeria amended the CBN decree no 24 of 1991 and placed the CBN under the Ministry of Finance; it mandated the CBN to report to the Presidency via the Minister of Finance and gave the final say on monetary policy to the Head of State. The military took away the power of monetary policy from the Central Bank and placed it with the Head of State.

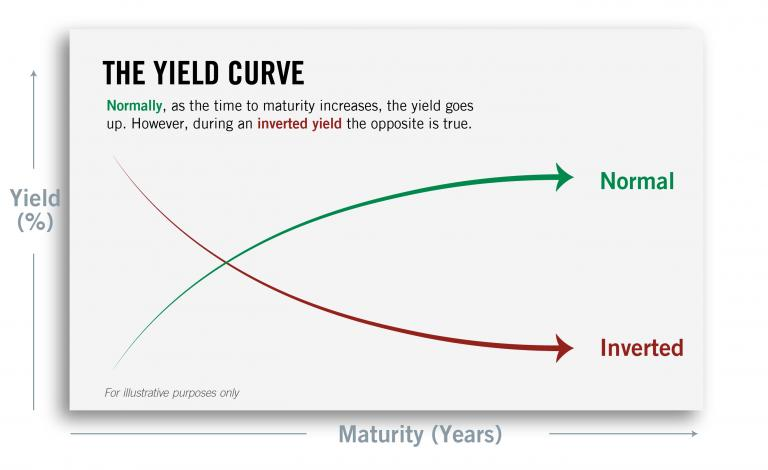

How Independent Central Banks Fight Inflation

The counter increased supply of Naira in any economy; the CBN will raise the interest rates in the economy by raising the MPR; this achieves two things.

- It makes it more expensive to borrow money, so even the Government reduces its spending

- It entices households to delay consumption and invest their cash in banks, thus reducing cash in circulation.

Nigeria Needs An independent CBN To Fight Inflation.

Currently, the inflation rate in Nigeria is 15.70% as of February 2022. Food inflation is higher at about 17.2%. Nigeria faces a perfect storm of high energy and food prices driven by imports of those crucial necessities. Inflation is everywhere in Nigeria; Nigerians see it in the exchange rate and even in the prices of presidential Expression of Interest and Nomination Forms, now costing N100m (The same forms cost N12m in 2019.)

The fiscal year has seen the Executive plan a record deficit budget of N6.25t; this excludes an N4t vote to import subsidized PMS. This record spending is adding to the inflation pressures in Nigeria. What has been the CBNs response?

The Nigeria CBN Is Fueling the FGN Spending

The CBN has been funding the Federal Spending via Ways & Means. Ways & Means Advances is a loan facility by the CBN to finance the government during temporary budget shortfalls. The CBN guidelines limit the amount available to the government under its Ways and Means Faculty to 5% of last year’s revenues; however, according to a Fitch Rating report in January 2021, “the FGN borrowings from the CBN repeatedly recorded around 80% of FGN 2019 revenues in 2020.”

The Federal Government Borrowing from CBN by FGN

- June 2015 N648b

- Dec 2015 N856b

- Dec 2016 N2.2t (with a T)

- Dec 2019 N3.3t

- Dec 2020 N4.9t

Total Advanced as of Aug 2921: N15.511t Note; This is not part of the total public debt.

The independent and autonomous CBN is contributing to inflation in Nigeria by funding the FGN deficit. This brings us back to this question? Who is the Central Bank of Nigeria serving? If its mandate is price stability, why is it printing N15t via Ways and Means in violation of Sec 38 of the CBN Act, which states “the total amount of such advance outstanding shall not exceed 5% of the previous year actual revenue of the federal government?

Excessive Deficit Spending Is Disastrous

The CBN, in its own Frequently Asked Questions (FAQ), states that “ the direct consequences of the central banks financing of deficits are disastrous or surges in the monetary base, leading to adverse effects on domestic prices and exchange rates, i.e. macroeconomic instability because of excess liquidity that has been injected into the system.”

Nigeria needs an independent CBN.