Inflation is here,

what is inflation?

In simple terms, a recession reduces the purchasing power of your currency. Look at the table below from my book Let’s Talk About Your Money. You see that if you earned N500,000 a year, with 15% inflation, your earnings are worth N434, 783. Inflation steals your money and really can’t do anything about it except growing your cash faster than inflation can take it

How to protect your portfolio from inflation

How to protect your budget from inflation

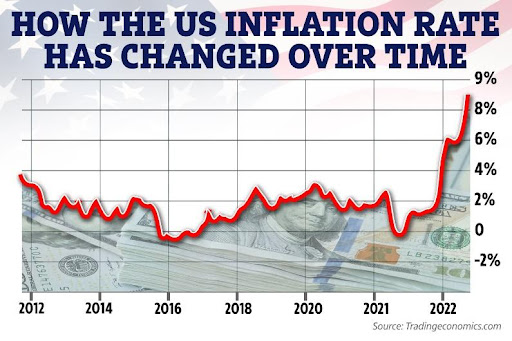

- Don’t keep your earnings in cash if you will not spend it in 90 days or less. If you have naira and want to spend it, convert it to USD and hold it. Are US dollars immune from inflation? No. US dollar inflation is about 8% as of May 2022, but it’s better than 17% Naira inflation.

- Earn more; if inflation will take away your cash value, try to see higher rates for your bank deposits, i.e., reduce the bleeding, for instance, like your bank for Commercial Paper rates, not just the banks Fixed Deposit rate.

- Prepay, lock in “lower” prices today. Suppose you buy particular goods, consider paying in advance. If you have lots of cash, deploy them to purchase long-term contracts with vendors. For E.g., will your kid’s schools allow you to pay for two years in advance at a discount? If yes, pay, transfer your cash to them, and lock in today’s rates. Same for goods like rice, buy in bulk, lock in your prices.

- Invest wisely. You will hear a lot of advice, e.g., stocks will fall if inflation rises, but the truth is there is no clear correlation.

Stock rises and falls even if inflation is up or down, as the table above referencing the US markets shows. The thing to do is to seek out stocks of companies that sell brands whose prices can rise without demand falling even during a recession, think Maggi cubes, cigarettes, even Petrol

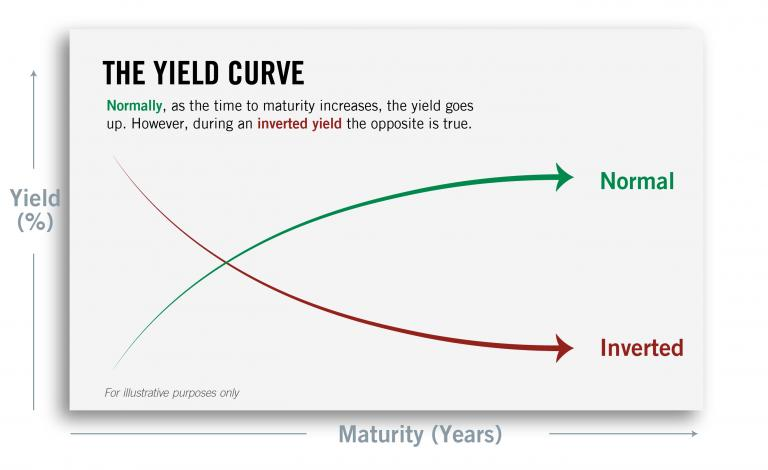

In summary, inflation affects currency’s purchasing power, so try not to be in cash but in commodities or assets that rise faster than inflation. if you must buy bonds, but short-tenured bonds

Check out my podcast on https://feeds.captivate.fm/the-way-i-see-it/

Comments are closed.